We don’t buy homes or invest into complexes because we expect to work forever.

Automated income, as it relates to you doing nothing, is a real...

There’s more to investing than 401(k)s, stocks, and bonds. Use our curated online resources to learn how commercial real estate investing can help you diversify your portfolio and grow your wealth as an accredited passive real estate investor.

Expand your commercial real estate portfolio with passive real estate investments and embrace the benefits of ownership without the active obligations. Learn how to find a reliable syndicator and the factors to consider that will help you choose the right deal.

Explore our library of how-to guides, tutorials and success stories to learn from

experienced passive real estate investors.

Taylor Swift and Travis Kelce aren't the only big thing happening in Kansas City in 2025. The Heart of America's commercial real estate market is...

Presented By:

The “transition to green energy” narrative has dominated headlines for some time now. The energy landscape is shifting dramatically,...

Presented By:

Nashville isn't just a cultural icon anymore, it's become one of the most dynamic real estate markets in the country. Over the past...

The Best Ever Conference returned for its ninth installment in March 2025, with BEC IX featuring an impressive cast of commercial real estate experts...

The Best Ever Conference returned for its ninth installment in March 2025, with BEC IX featuring an impressive cast of commercial real estate experts...

The Best Ever Conference returned for its ninth installment in March 2025, with BEC IX featuring an impressive cast of commercial real estate experts...

The Best Ever Conference returned for its ninth installment in March 2025, with BEC IX featuring an impressive cast of commercial real estate experts...

Presented by:

Smart real estate investors know that success isn't just about generating income—it's also about maximizing tax efficiency. Mobile...

There are endless real estate syndications that target returns in the mid-teens and higher.

But some of them are riskier than aging buffet sushi,...

In my 20s and 30s, I owned around 20 rental properties. Today I own no properties directly — but I have an ownership interest in over 2,500 units.

...

Presented by:

As an investor, it's important to educate yourself by reviewing as many resources as you can. At Viking Capital, our team has created...

If you didn’t have a penny of your own money invested in a property, but you earned $250 per month on it, what’s your return on investment? Well, you...

.png)

Generally, the general partner (GP) in an apartment syndication has certain investment criteria to determine which deals to submit offers. These...

Presented by:

The private market landscape in 2023 presented a mix of challenges and opportunities for limited partners (LPs). Despite a 22% decline...

.png)

After closing on an apartment syndication deal, one of the responsibilities of the general partners (GP) is to provide the limited partners (LP) with...

So, you want to buy a property. Or you want to invest in a syndication. Either way, you are investing equity, which will be combined with a mortgage...

Anyone can become a millionaire, given enough time.

No, really — if you set aside $165 per month and earned a long-term average 10% return (similar...

There are three main steps to take an apartment deal from contract to close. First, the apartment syndicator performs detailed due diligence to...

.png)

Presented by:

Meet Trevor McGregor, renowned worldwide as a master of High Performance and Business Strategy Coaching, with a legacy deeply rooted...

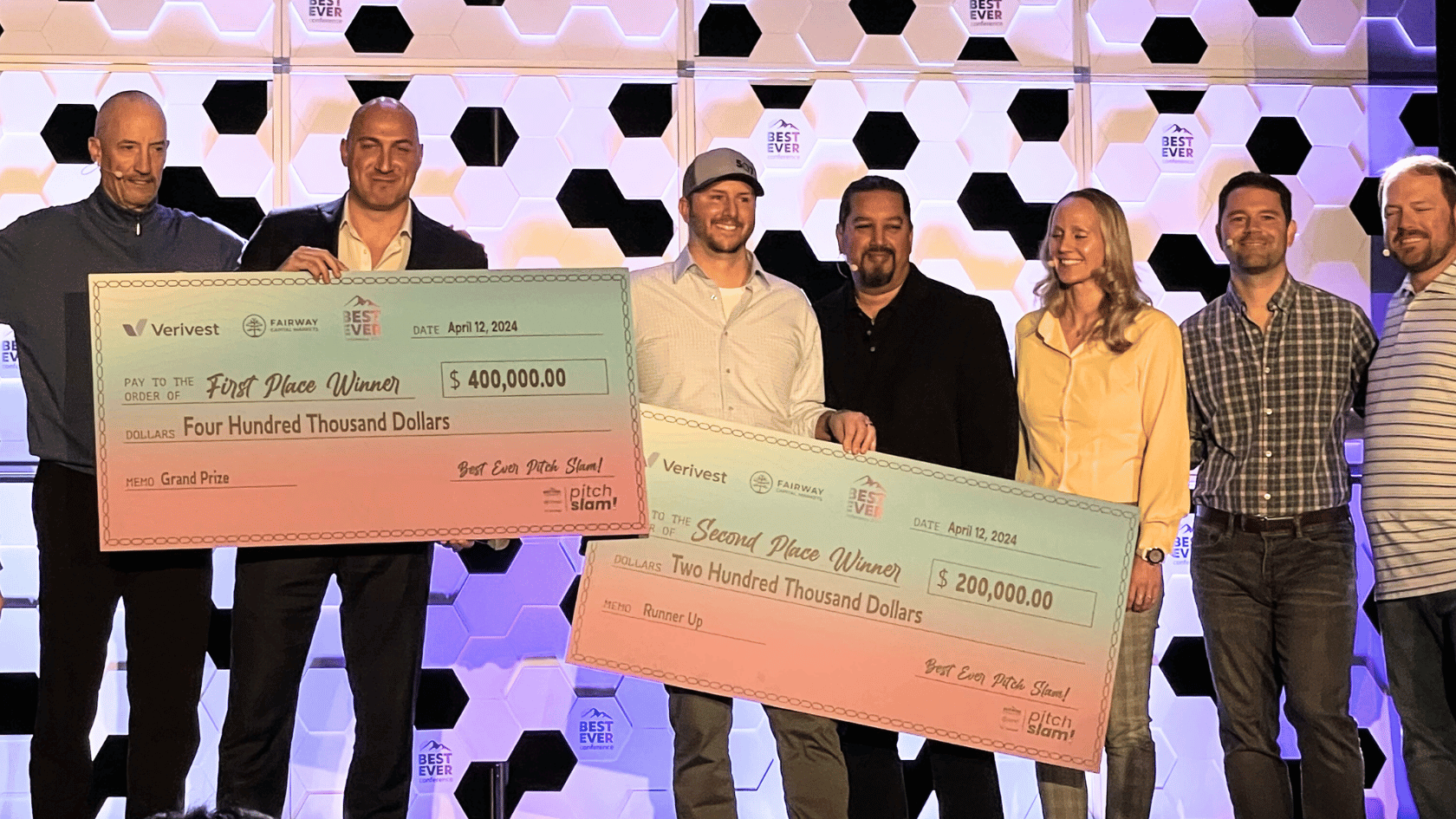

The second and third days of the Best Ever Conference offered attendees an immersive experience, brimming with invaluable insights from a lineup of...

.png)

The Best Ever Conference has kicked off with a bang at the Hyatt Regency in Salt Lake City, UT, and it's already proving to be an unforgettable...

.png)

Presented by:

Every day, individuals achieve success, with many ultimately building wealth. Those who consistently generate wealth develop habits...

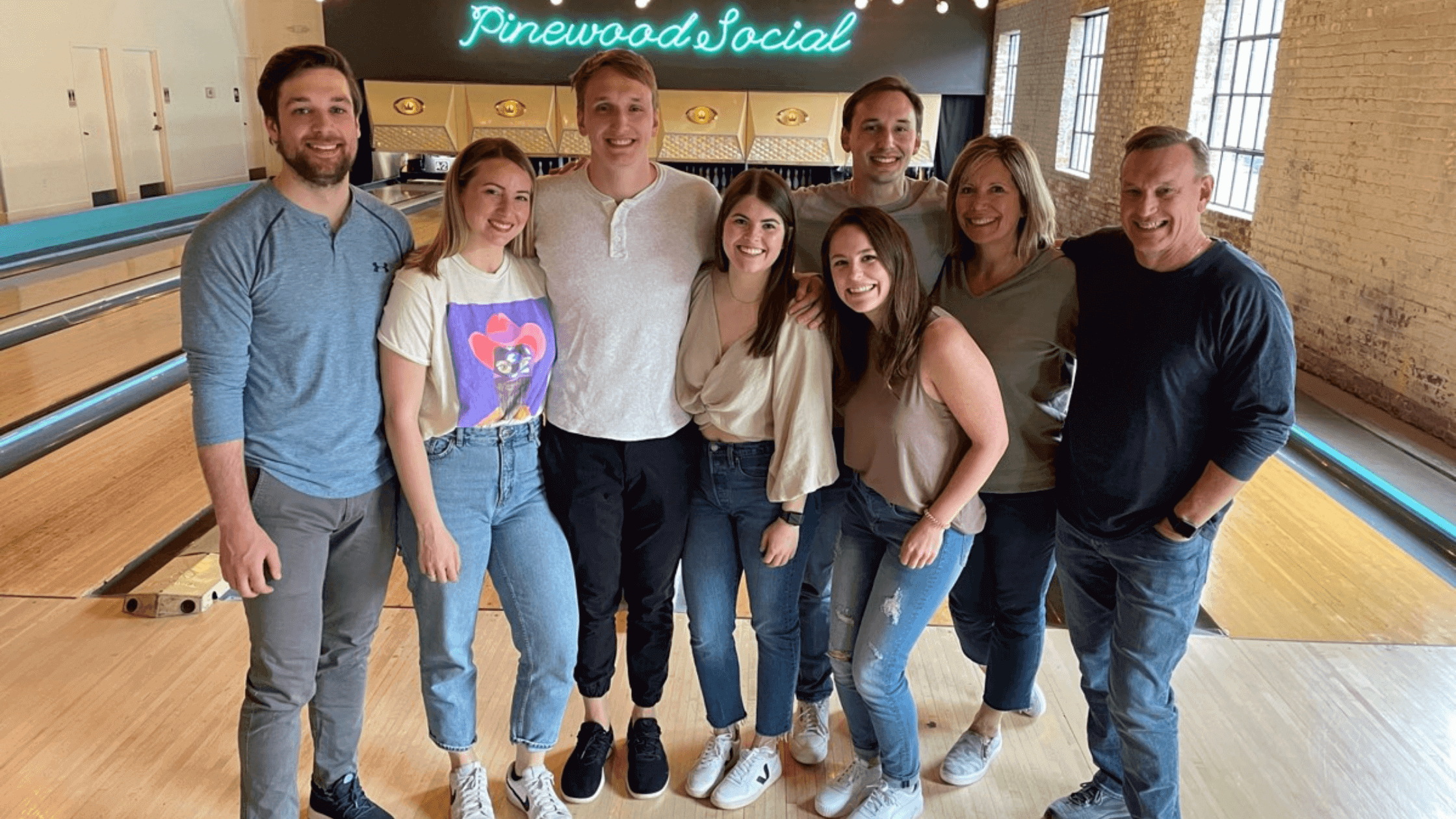

One of the many benefits of investing in real estate syndications is that you don't have to live — or even travel to — where you invest. As a passive...

The concept of 50/50 goals is that 50% of a goal’s success is based on achieving the quantifiable outcome and 50% is based on identifying a lesson...

Presented by:

While real estate offers plenty of opportunity for profitable investment, commercial real estate, in particular, offers several...

College is crazy expensive. For the 2023–2024 school year, the average private college tuition was $42,162. Yikes. Fortunately, there are plenty of...

Whether you're just starting or have years of investing experience, you are always on the hunt for the perfect deal. But if someone put the perfect...

.png)

Like most who invest in real estate, I started with single-family homes.

That was 20 years ago. Today I haven’t the slightest interest in owning...

.png)

Benjamin Franklin famously remarked, “In this world, nothing can be said to be certain, except death and taxes.”

That may be true for the average...

Navigating the transition from a limited partner (LP) to a general partner (GP) role in real estate syndication is a significant and exciting step. ...

Presented by:

When it comes to commercial real estate investment, choosing the right up-and-coming cities is crucial for value and growth potential....

When you begin passively investing in syndications, you’ll often hear about the importance of vetting a sponsor. I’ve heard it for years, and I...

After a rocky and tumultuous 2023, real estate investors are hoping for a prosperous year in 2024. But “hope” isn’t a strategy, so it would be hard...

.png)

Real estate investing offers a myriad of strategies, each with its own set of benefits and considerations. So which one is right for you?

Nearly...

Real estate syndications are increasingly becoming more mainstream, for good reason. When done correctly, real estate syndications are a powerful...

If you ask random people off the street about their options for investing in real estate, you’ll hear answers like “rental properties,” “flipping...

Presented by:

Even experienced private equity investors should continue honing their due diligence checklists. Using a set of key questions allows...

Presented by:

Texas has become a top destination for real estate investors thanks to its thriving economy and attractive multifamily fundamentals....

As the year comes to a close, real estate investors have a unique opportunity to ensure their investments are in good legal standing, optimize their...

.png)

Investors often turn to real estate for diversification, as it has historically shown a low correlation with the broader stock market, making it a...

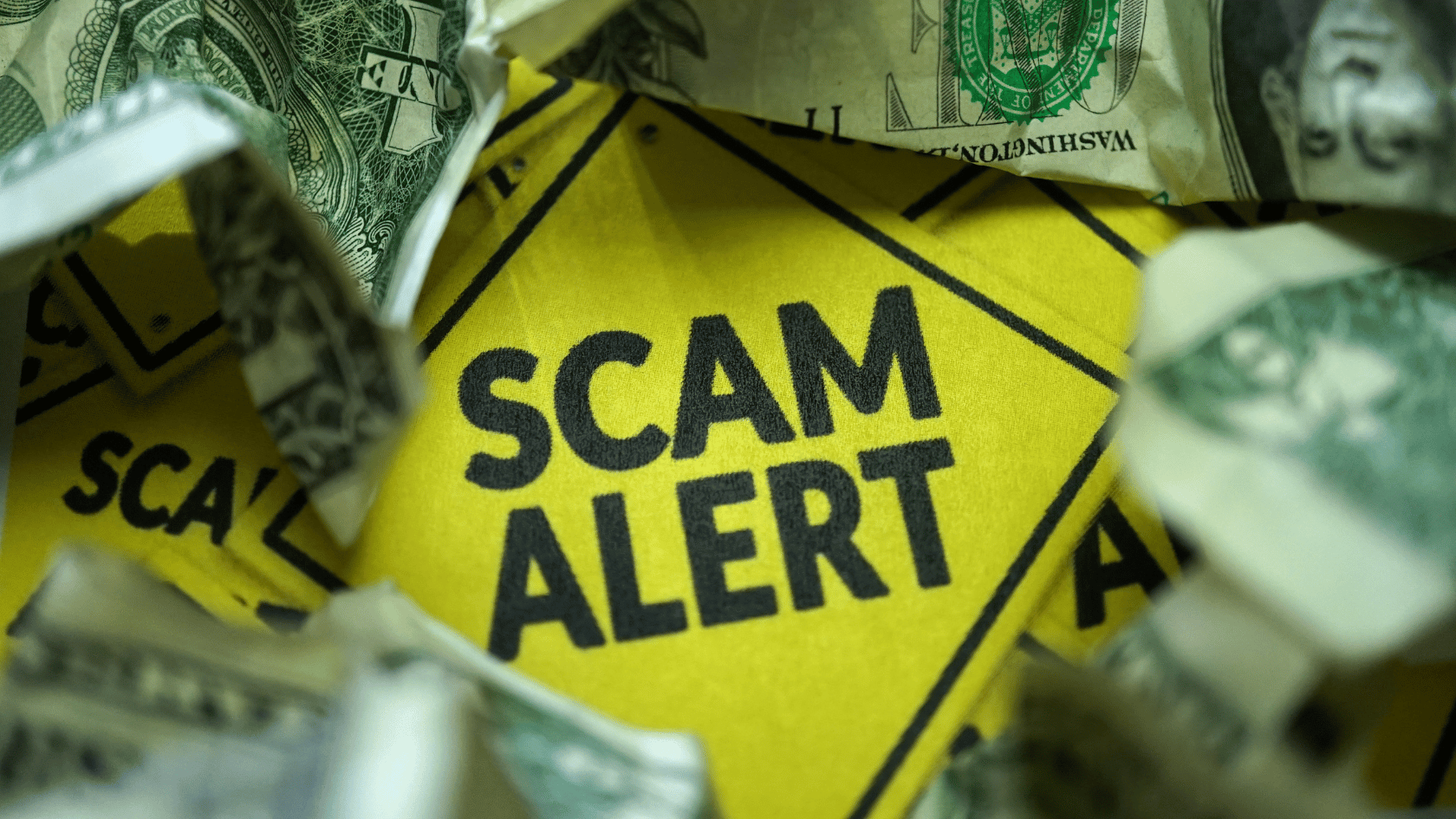

Falling for a real estate scam is the fear of every novice investor. Many assume that scams only target the elderly and gullible, but the truth is...

Presented by:

In the dynamic landscape of the commercial real estate market, sustainability is emerging as a key driver of future trends and...

Presented by:

Real estate investing offers a myriad of opportunities for those seeking to build wealth and achieve financial independence. Whether...

As investors continue to look for opportunities during this challenging economic climate, multifamily investors from across the country descended...

Presented by:

Whether you’re a seasoned investor or you’re thinking about investing in commercial real estate for the first time, it’s a complex...

When you’re a passive investor in a real estate deal, one of the first tips you’ll receive is to invest with groups with strong track records. This...

Presented by:

The world is witnessing the undeniable impacts of climate change, with the United States experiencing high-temperature extremes and...

In recent years, coworking has gained significant traction, revolutionizing the traditional workplace and offering professionals a flexible and...

Market selection is a critical step in the investing process. Understanding the benefits and drawbacks of investing in growth and stable markets can...

Regulation D is an exemption that allows issuers to sell securities without registering those securities. Two very common subparts of Regulation D...

Presented by:

Investing in commercial real estate has long been considered a cornerstone of a robust and diverse portfolio. Yet, like every other...

Limited partners are getting more nervous about some of the investments they’ve made over the last few years. Interest rates have risen faster than...

Presented By:

Real estate investment has long been recognized as a smart and effective way to grow wealth. But beyond the potential for significant...

Senate Democrats have put forth a new bill known as the Stop Predatory Investing Act.

The primary aim of the bill appears to be to target massive...

With the increasing prevalence of AI, I turned to ChatGPT to uncover the most common Internet searches related to real estate investing. According to...

.png)

A real estate investment plan is a comprehensive guide that outlines the strategy, tactics, and goals for yourpassive real estate investments. It...

With this year’s Best Ever Conference around the corner, attendees will have the opportunity to take advantage of a variety of incredible...

Socially responsible investing can mean many things to different people. But what does it mean in the context of multifamily investing? Social...

Depending on who you ask, we are either in a recession, heading into a recession, or will narrowly escape a recession. Nonetheless, inflation has...

The S&P 500 is on course to post its worst annual performance since the Great Financial Crisis. Understandably, many people are looking to protect...

The U.S. is in a recession by traditional definitions: depending on your source, several months or two consecutive quarters of economic slowdown....

In 2013, I recall my wife's uncle introducing me to Robinhood for the first time. He said it was a game-changer for anyone looking to invest in the...

Cinderella (not her real name) is a bright young millennial who believes in planning for the future by investing now. She is a confident young woman...

When it comes to real estate investing, it's important to stay on top of your portfolio and be prepared for anything. With renewed concerns over...

It's an uncertain time for investors right now with the tide of inflation impacting spending at home, and eyebrows being raised with post-pandemic...

There are two options for investing in multifamily real estate mentor. You can either be an active investor, where you find and manage the deal, or a...

“Don’t waste your money or time advertising on the radio.”

“The radio is prehistoric.”

“No one listens to the radio anymore.”

I am certain you’ve...

We don’t buy homes or invest into complexes because we expect to work forever.

Automated income, as it relates to you doing nothing, is a real...

Passive investors in private real estate often have two investment structures available to them: a single-asset offering or a fund-style offering....

The approach is used as the basis for comparative market analysis (C.M.A.), which is an analysis of the prices of recently sold properties that...

Once a syndicator puts an apartment deal under contract, concurrent with the due diligence process is the process of securing investment...

There are close to 12,000 professional athletes in the United States. The vast majority are not multi-millionaires and will have short careers and...

One selling point for many operators is their vertical integration. A vertically integrated real estate operator is one that has all components of...

As an investor, one of your responsibilities is to evaluate the market before jumping into any investment. Market projections allow you to assess...

Do you consider mixed-use properties when looking for commercial real estate deals?

Many investors love multifamily but struggle to wrap their heads...

Dan Handford, Managing Partner, PassiveInvesting.com

Dan Handford began his presentation by...

Due to the nature of commercial real estate syndications and the SEC rules under which many syndicators operate, it can be challenging to know where...

In the past, there have been a lot of people sharing the four Ps for raising capital. However, successful entrepreneur and author Reed Goossens added...

Now that it’s officially 2022, it’s time to set yourself up for real estate success with the upcoming year ahead. So, what do you have to do to make...

Green investors often ask how they can get started in the multifamily space when they aren’t yet designated as accredited investors. According to the...

These last few years, real estate investors have been shifting their capital to...

As Dr. Brian Jager began his medical career, he noticed that the field of anesthesiology was underserved. The ability to diagnose, create and execute...

“It depends,” is a normal lawyer response to just about any question. So, it is no surprise that was a response recently when a client asked me,...

Rome Lingenfelter is a commercial real estate mogul who loves teaching others so that they gain financial freedom. He began investing a few years ago...

As an intellectual property lawyer for some of the world’s most notable technology companies including Microsoft and Facebook, JB Im spends most of...

You want to buy a certain property. However, before you can raise capital for this deal, you have a crucial task at hand: You must form your sales...

Passive real estate investing is a great way to get started in the industry. You can use passive investments to put your capital toward multifamily...

Running a commercial real estate business is a lot of work. You’ve got to investigate opportunities, market your brand, and close deals, all while...

For retired Air Force serviceman Josh Weed, reentering civilian life felt like entering another universe. There were many things to adjust to:...

With 2021 in the rearview, most people are looking to create an amazing 2022. One of the best ways to prepare for success in the new year is by...

Finding passive investors for an apartment deal is an important step that needs to be completed on any apartment syndication upfront.

When you’re...

Scott Vonderharr sat at his father’s retirement party, listening to him regale his friends and family with a story. This story wasn’t about a...

If you own or manage an apartment, you know that tenants can do severe and lasting damage to their residences. Sometimes unavoidable accidents occur;...

FOR LISTENERS

Check out the Best Ever Show podcast for straightforward advice for passive real estate investing, and none of the fluffy stuff.

An accredited passive investor is a person that can invest in securities (i.e. invest in an apartment syndication as a limited partner) by satisfying one of the requirements regarding income or net worth. The current requirements to qualify are an annual income of $200,000 or $300,000 for joint income for the last two years with expectation of earning the same or higher or a net worth exceeding $1 million either individually or jointly with a spouse.

An apartment syndication is a temporary professional financial services alliance formed for the purpose of handling a large apartment transaction that would be hard or impossible for the entities involved to handle individually, which allows companies to pool their resources and share risks and returns. In regards to apartments, a syndication is typically a partnership between general partners (i.e. the syndicator) and the limited partners (i.e. the investors) to acquire, manage and sell an apartment community while sharing in the profits.

A sophisticated investor is a person who is deemed to have sufficient investing experience and knowledge to weigh the risks and merits of a commercial real estate investment opportunity.

The general partner (GP) is an owner of a partnership who has unlimited liability. A general partner is also usually a managing partner and active in the day-to-day operations of the business. In apartment syndications, the GP is also referred to as the sponsor or syndicator. The GP is responsible for managing the entire apartment project.

The limited partner (LP) is a partner whose liability is limited to the extent of the partner’s share of ownership. In apartment syndications, the LP is the passive investor and funds a portion of the equity investment.

Capital expenditures, typically referred to as CapEx, are the funds used by a company to acquire, upgrade and maintain an apartment community, often through a commercial property management company. An expense is considered to be a capital expenditure when it improves the useful life of an apartment and is capitalized – spreading the cost of the expenditure over the useful life of the asset.

Capital expenditures include both interior and exterior renovations.

Examples of exterior CapEx are repairing or replacing a parking lot, repairing or replacing a roof, repairing, replacing or installing balconies or patios, installing carports, large landscaping projects, rebranding the community, new paint, new siding, repairing or replacing HVAC and renovating a clubhouse.

Examples of interior CapEx are new cabinetry, new countertops, new appliances, new flooring, installing fireplaces, opening up or enclosing a kitchen, new light fixtures, interior paint, plumbing projects, new blinds and new hardware (i.e. door knobs, cabinet handles, outlet covers, faucets, etc.).

Examples of things that wouldn't be considered CapEx are like the costs associated with turning over a unit (i.e. paint, new carpet, cleaning, etc.), ongoing maintenance and repairs, ongoing landscaping costs, payroll to employees, utility expenses, etc.

Operating expenses are the costs of running and maintaining the property and its grounds.

For example, here are operating expenses for a 216-unit apartment community:

| Payroll | ($239,790) |

| Maintenance | ($65,397) |

| Contract Services | ($82,837) |

| Turn/Make Ready | ($43,598) |

| Advertising | ($32,699) |

| Admin | ($32,699) |

| Utilities | ($190,742) |

| Mgmt Fees | ($65,788) |

| Taxes | ($280,825) |

| Reserves | ($54,000) |

| Insurance | ($49,048) |

| Total Expenses | ($1,137,424) |

Debt service is the annual mortgage paid to the lender, which includes principal and interest. Principal is the original sum lent and the interest is the charge for the privilege of borrowing the principal amount.

For example, a 24-month $11,505,500 loan with 5.28% interest amortized over 30 years results in a debt service of $60,977 per month.

Net operating income (NOI) is all revenue from the property minus operating expenses, excluding capital expenditures and debt service.

For example, a 216-unit apartment community with a total income of $1,879,669 and total operating expenses of $1,137,424 has a NOI of $742,245.

Capitalization rate, typically referred to as cap rate, is the rate of return based on the income that the property is expected to generate. The cap rate is calculated by dividing the property’s net operating income (NOI) by the current market value or acquisition cost of a property (cap rate = NOI / Current market value)

For example, a 216-unit apartment community with a NOI of $742,245 that was purchased for $12,200,000 has a cap rate of 6.1%.

Price per unit is the cost of purchasing an apartment community based on the purchase price and the number of units. The price (or cost) per unit is calculated by dividing the purchase price by the number of units.

For example, a 216-unit apartment community purchased for $12,200,000 has a price per unit of $56,481.

Cash flow is the revenue remaining after paying all expenses. Cash flow is calculated by subtracting the operating expense and debt service from the collected revenue

For example, here is the cash flow of a 216-unit apartment community:

| Total Income | $1,879,669 |

| Total Operating Expense | $1,137,424 |

| Debt Service | $581,090 |

| Asset Mgmt Fee | $40,195 |

| Cash Flow | $120,960 |

Closing costs are the expenses, over and above the price of the property, that buyers and sellers normally incur to complete a real estate transaction.

Examples of closing costs are origination fees, application fees, recording fees, attorney fees, underwriting fees, credit search fees and due diligence fees.

The sales proceeds are the profit collected at the sale of the apartment community.

For example, here is a how the sales proceeds is calculated for a 216-unit apartment community purchased at $12,200,000 and sold after a five year value-add business plan:

| Exit NOI | $1,134,723 |

| Exit Cap Rate | 5.9% |

| Exit Price | $19,232,593 |

| Closing Costs | ($192,326) |

| Remaining Debt | ($10,711,909) |

| Sales Proceeds | $8,328,358 |

The internal rate of return (IRR) is the rate, expressed as a percentage, needed to convert the sum of all future uneven cash flow (cash flow, sales proceeds and principal pay down) to equal the equity investment. IRR is one of the main factors the passive investor should focus on when qualifying a deal.

A very simple example is let’s say that your real estate investment is $50. The investment has cash flow of $5 in year 1, and $20 in year 2. At the end of year 2, the investment is liquidated and the $50 is returned.

The total profit is $25 ($5 year 1 + $20 year 2).

Simple division would say that the return is 50% ($25/50). But since time value of money (two years in this example) impacts return, the IRR is actually only 23.43%.

If we had received the $25 cash flow and $50 investment returned all in year 1, then yes, the IRR would be 50%. But because we had to "spread" the cash flow over two years, the return percentage is negatively impacted.

The timing of when cash flow is received has a significant and direct impact on the calculated return. In other words, the sooner you receive the cash, the higher the IRR will be.

The cash-on-cash (CoC) return is the rate of return, expressed as a percentage, based on the cash flow and the equity investment. CoC return is calculated by dividing the cash flow by the initial investment.

For example, a 216-unit apartment community with a cash flow of $330,383 and an initial passive real estate investment of $3,843,270 results in a CoC return of 8.6%

Equity Multiplier (EM) is the rate of return based on the total net profit (cash flow plus sales proceeds) and the equity investment. EM is calculated by dividing the sum of the total net profit and the equity investment by the equity investment.

For example, if the limited partners invested $3,843,270 into a 216-unit apartment community with a 5-year gross cash flow of $2,030,172 and total proceeds at sale of $6,002,116, the EM is ($2,030,172 +$ 6,002,116) / $3842,270 = 2.09.

The market rent is the rent amount a willing landlord might reasonably expect to receive, and a willing tenant might reasonably expect to pay for a tenancy, which is based on the rent charged at similar apartment communities in the area. Market rent is typical calculated by performing a rent comparable analysis.

The gross potential rent (GPR) is the hypothetical amount of revenue if the apartment community was 100% leased year-round at market rental rates.

For example, here is how the GPR is calculated for a 216-unit apartment building:

| Unit Type | # of Units | Bed/Bath | Market Rent |

| A1 | 48 | 1x1 | $737 |

| A2 | 96 | 1x1 | $796 |

| B1 | 72 | 2x1 | $990 |

| GPR | $183,072 |

The gross potential income is the hypothetical amount of revenue if the apartment community was 100% leased year-round at market rates plus all other income.

For example, a 216-unit apartment community with a GPR of $183,072 and monthly other income of $14,153 from late fees, pet fees and a RUBS program has a gross potential income of $197,225 per month.

Loss to lease (LtL) is the revenue lost based on the market rent and the actual rent. LtL is calculated by dividing the gross potential rent minus the actual rent collected by the gross potential rent.

For example, a 216-unit apartment community with a GPR of $183,072 and with an actual rent of $157,270 has a LtL of 14%.

Bad debt is the amount of uncollected money a former tenant owes after move-out.

Concessions are the credits (dollars) given to offset rent, application fees, move-in fees and any other revenue line time, which are generally given to tenants at move-in.

A model unit is a representative apartment unit used as a sales tool to show prospective tenants how the actual unit will appear once occupied.

An employee unit is a unit rented to an employee at a discount or for free.

Financing fees are the one-time, upfront fees charged by the lender for providing the debt service. Also referred to as a finance charge. Typically, the financing fees are 1.75% of the purchase price.

For example, a 216-unit apartment community purchased for $12,200,000 will have an estimated $213,500 in financing fees.